extended child tax credit dates

Heres what to know about the fifth CTC check. Unless parents opt-out and take all the money at tax time the monthly payments will be sent to eligible families by direct deposit or check on.

Tax Return Refund Deposit Options Explore The Best Payment In 2021 Tax Deadline Estimated Tax Payments Tax Extension

Prior to 2021 the child tax credit provided families with kids ages 0 to 16 with up to 2000 per qualifying dependent.

. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5 and. Extended ARP child tax credit. Here are the remaining dates by which you would need to unenroll.

But others are still pushing for. Best public high schools in Ohio However if the Build. This means that the total advanced credit amount delivered in 2021 will be.

Enter Payment Info Here tool or. No Tax Knowledge Needed. The last round of monthly child tax credit payments will arrive in bank accounts on dec.

White House urges parents to file taxes to get second half of Child Tax Credit 0716. The IRS will issue advance Child Tax Credit payments on these dates. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for school-age children and.

Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. The last monthly child tax credit payment will be Dec15 unless Congress passes legislation to extend it. In 2021 this tax credit was increased to.

TurboTax Makes It Easy To Get Your Taxes Done Right. Taxpayers will receive several letters. The 6 monthly Child Tax Credit payment amounts will total.

Treasury secretary janet yellen encourages americans to take advantage of tax credits including the expanded child tax credit and earned income tax credit in the south court auditorium on the. Sarah tewcnet this story is part taxes 2022cnets coverage of the best tax software and. 1 for November payment Nov.

Congress fails to renew the advance Child Tax Credit. Here are the official dates. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

For children age 6 through 17. For children under age 6. The payments will be made either by direct deposit or by paper.

4 for October payment Nov. The expanded tax credit delivers monthly payments of 300 for each eligible child under 6 and 250 for each child between 6 to 17 years old. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents.

How is it different. July 15 August 13 September 15 October 15 November 15 and December 15. On the 15th of each month parents who signed up received payments of up to 300 per child under age 6 and 250 per child ages 6 to 17.

Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. 29 for December payment Could the child tax credit be extended. As it stands right now payments will not continue into 2022.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the. Ad Capture Your W-2 In A Snap And File Your Tax Returns With Ease. This will be half of the total amount paid out with the other half.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. For children age 6 through 17.

WJWAP The final Child Tax Credit payment of 2021 hits accounts this week. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments.

Child Tax Credit 2022 Schedule December Child Tax Credit 2022 Schedule December. 2022 Child Tax Credit Date 2022 Child Tax Credit Date. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. For children under age 6. The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax filing.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Currently a single parent on an annual salary of less than 200000 and married parents on less than 400000 are able to.

The Child Tax Credit Checks Are Here How Are Parents Spending Them The Lily In 2022 Child Tax Credit Tax Credits Form Of Government

2019 Tax Extension Deadline Form Google Search Tax Extension Irs Taxes Tax Deadline

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting Small Business Expenses Small Business Tax Tax Checklist

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits

R And D Tax Credit Relief Research And Development Development Tax Credits

Tax Formula Tax Tax Deductions Income Tax

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

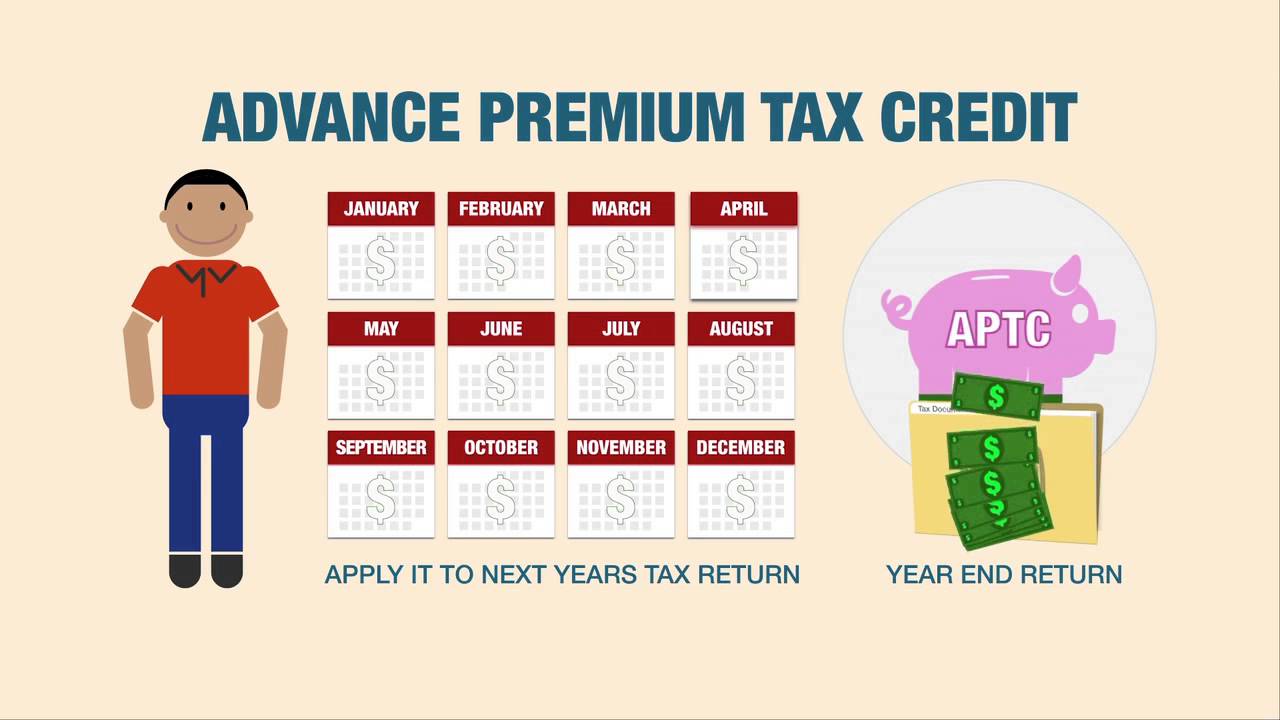

Health Insurance Marketplace Advance Premium Tax Credit Marketplace Health Insurance Health Insurance Plans Tax Credits

What Is The Home Renovation Tax Credit Tax Credits Renovations Home Renovation

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

Bra Extends Personal Income Tax Filing Deadline Barbados Today Filing Taxes Income Tax Tax Filing Deadline

Credit Report Template Free Printable Documents Annual Credit Report Credit Bureaus Credit Report

How Long To Keep Your Tax Returns And Records Good Money Sense Financial Documents Tax Return Money Sense

Estimated Irs Tax Refund Schedule Dates Irs Taxes Tax Refund Irs

September 2020 Business Due Dates Due Date Business Income Tax Return